Bean Farmers · April 3rd, 2023

How Beanstalk Tackles the Stablecoin Trilemma

A look at $BEAN price stability, decentralization, and capital efficiency

This is the first post by the Bean Farmers initative - a collection of humble Bean Farmers, commissioned by Beanstalk Farms, in order to spread the story, motivation and mechanisms behind Beanstalk. This is the first part of an educational series highlighting key features and differentiators of Beanstalk from other stablecoins.

What is a Stablecoin?

At this point in the development of DeFi, all signs point to stablecoins as one of the “killer use cases” for on-chain finance. Just like their traditional currency predecessors, stablecoins serve three basic monetary purposes by functioning as a unit of account, a store of value, and a medium of exchange. In satisfying these three pillars, stablecoins allow anyone worldwide to transact in a completely permissionless way. These transactions should one day include buying physical goods and services, investing in income-producing assets, and much more.

In order to serve these purposes well, a stablecoin must have the following properties:

- Low-volatility;

- Frictionless in both speed and cost.

But that isn’t the full potential of what stablecoins can be: on-chain dollars like USDC satisfy these conditions, but not in a decentralized or capital efficient manner. Stablecoins begin to get interesting when centralization is eliminated, relying on immutable code and economic incentives for peg stability instead of backing the stablecoin with dollars in a company's bank account.

This concept of a code-first financial system is the cutting edge of money, and within this there are limitless possibilities for innovation and potential use cases. Beanstalk is one of these experiments, and in this post we look at how its design measures up.

The Trilemma

Like blockchains themselves, stablecoin designs can be viewed within a trilemma framework. The three key ways to assess a stablecoin in this framework are:

- Decentralization: Does any centralized entity have control over the monetary supply, or who can use the coin? Can transactions be blocked or censored? Are censorable assets used as reserves or collateral?

- Price Stability: How tightly does the stablecoin hold its intended peg? Is it a soft or a hard peg? What mechanisms are in place to regain the peg if price deviates? How often does the price cross its peg?

- Capital Efficiency: Are asset reserves utilized to back the value of the coin? If so, what is the collateralization ratio? If not, what other limitations exist for scaling the supply?

In order to identify where $BEAN sits within the trilemma, let’s break it down one side of the triangle at a time.

Price Stability

Price stability is the most technical component of the trilemma to discuss, due to the algorithmic processes for peg maintenance that are at the core of Beanstalk. From a monetary perspective, price stability is required in order to be a medium of exchange or unit of account. $BEAN’s intended peg is $1, but it is considered a “soft peg.” Given that $BEAN has no collateral (see Capital Efficiency), it is not possible for Beanstalk to fix the price at $1. Instead the mechanism incentivizes market participants to cross $BEAN price above and below $1. The idea with this soft peg system is that the $BEAN price can oscillate more tightly around its peg over time, delivering a level of stability that will be attractive to transact with.

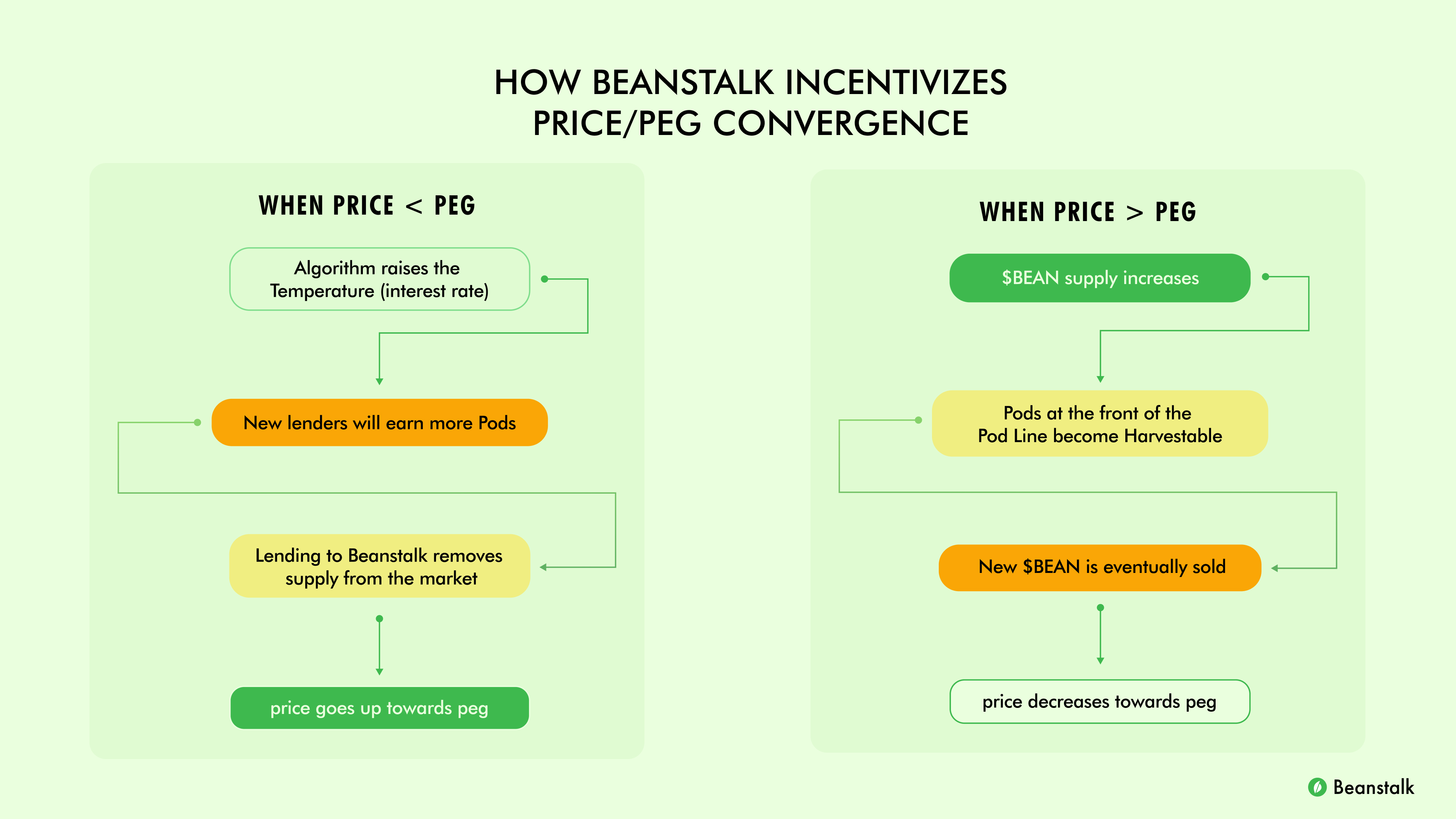

$BEAN is an algorithmic stablecoin (zero collateral), and every hour the protocol adjusts certain components to encourage market participants to align the $BEAN price to the 3CRV price on Curve. The adjustments attempt to incentivize $BEAN holders to lend to Beanstalk when the price is below peg.

Lenders sow $BEAN to receive Pods (shares of Beanstalk debt), which are each redeemable for 1 $BEAN in the future. In order to incentivize lending, the number of Pods per $BEAN lent is determined by the Temperature (interest rate) in the system. The algorithm adjusts this rate in an attempt to incentivize lending activity that will converge the $BEAN price with its intended peg. Debt issued by Beanstalk is repaid on a FIFO basis, so earlier loans come to term first, and the duration is variable based on the need for the protocol to mint new Beans (if the price is too high).

Recent Stability

In theory, $BEAN can sit in the middle of the triangle, but reality doesn’t always match up. Currently, $BEAN is much stronger on Decentralization and Capital Efficiency than its Price Stability, sitting below peg for the past 4 months. The peg mechanism relies on attracting creditors to lend $BEAN by offering a competitive yield, but without requisite demand, it can’t lower the supply when below peg. This is the main tradeoff $BEAN makes within the trilemma— the system is more prone to more prolonged or significant depegs than some other types of stables.

Price chart shows instances of depegs and recoveries over $BEAN history

Decentralization

Addressing the questions surrounding $BEAN’s decentralization is more straightforward. Since $BEAN derives its value endogenously from Beanstalk’s creditworthiness, there is no need to hold any centralized asset reserves like USDC and DAI both do.

Furthermore, Beanstalk is permissionless, meaning that anyone can participate in the system. Centralized stablecoins like $USDC and $USDT have been known to censor transactions and blacklist addresses based on their own discretion or guidance from regulators.

Beanstalk is governed by a DAO that operates the $BEAN system through smart contracts. The DAO, aka the Silo, is where $BEAN and other whitelisted assets can be deposited to earn Stalk and Seeds, as well as a portion of newly minted $BEAN. Stalk represents a share of the total DAO voting power and entitles the holder to a portion of the newly minted $BEAN. Seeds generate Stalk over time. This dilutes older Stalkholders, decentralizing governance power concentration as the protocol grows. Overall, once $BEAN moves back to on-chain governance, it will be maximally decentralized.

Capital Efficiency

Capital efficiency is what determines the scalability of a stablecoin, and similar to the decentralization level, it is quite high within the $BEAN system. With no need to hold reserve assets, the system doesn’t incur any negative carry from locking up assets as collateral.

Asset-backed models need to maintain reserves that can incur negative carry, either through interest payments on a CDP-style stablecoin like $DAI, or through the opportunity cost of lending those assets out to borrowers. $BEAN has a positive carry due to 1) having no reserves and 2) the seigniorage earned from depositing in the Silo, making it more capital efficient.

The creditworthiness of Beanstalk is what gives $BEAN its intrinsic value, so its supply can scale appropriately to meet higher demand. Theoretically, the only limitation on scaling is the amount of on-chain liquidity available to trade against $BEAN.

A Summary of Trade Offs

Beanstalk is a bold monetary experiment, capable of offering a legitimate solution to the stablecoin trilemma, but requires a reliable line of willing creditors to do so. The decentralization and capital efficiency of the model are strong, however, price stability relies on the willingness of people to lend $BEAN to the protocol. While the design holds the possibility of a major breakthrough in the algorithmic stablecoin sector, efforts are being made to bolster the demand for $BEAN so that possibility can be realized.

Devs in the Beanstalk ecosystem are indeed hard at work, with some new venues for $BEAN liquidity on the horizon. Beyond development, the DAO is extremely knowledgeable and always eager to educate newcomers on what is, admittedly, a complex system. More posts like this are to come, clearly laying out the value of $BEAN and the mechanisms that make it work. In the meantime, you can join the loyal Farmers over on Discord to get updates, ask questions, and learn more about participating in the ecosystem.